As per notification no. 11/2017 dated June 28, 2018, Goods Transportation Agency is a person who provide the service in relation to transport good by road and issue a consignment document.

As mentioned in above definition, the person who issue consignment note will be a Goods Transportation Agency . The person who is providing goods transportation service by road and not issuing consignment note will not be considered as GTA.

What is Consignment Note?

Consignment note means a document, issued by the GTA as a acknowledgment of receipts of goods for transporting them by road.

Issuing consignment note will make transporter responsible for making safe delivery. If any damages incurred the transporter will have liability. But in zero-rate supply, outward liability is at zero rate, and tax law permits claiming ITC on purchases made. For unutilized credit, taxpayers can claim a refund.

Service Covered under Goods Transportation Agency:

If GTA does not provide following services independently, then they will be part of GTA services:

- Loading/unloading;

- Packing/ unpacking;

- Trans-shipment and

- Temporary warehousing etc.

If GTA services provided to followings person, then only liability will arise:

- Any factory registered under the Factories Act, 1948;

- Any Society registered under Societies Registration Act, 1860 or any other law;

- Any co-operative society registered under any law;

- Any person registered under GST Act, 2017;

- Anybody corporate (as defined in Companies Act, 2013);

- Any partnership firm or Association of person (AOP) whether registered or not and

- Any casual taxable person located in taxable territory.

The following supplies are notified as deemed supplies:

- Supply of goods by a taxpayer against advance authorization (AA). Advance authorization is permission issued by the director general of foreign trade for the import or domestic purchase of material for physical export.

- Supply of capital goods by a taxpayer against EPCG (export promotion capital goods authorization)

- Supply by a taxpayer to an export-oriented unit (EOU).

- Supply of gold by a bank or PSU against AA.

Here after referred as “Specified Recipients”

Who is liable to pay GST on service and at what rate?

1. If GTA opt to pay GST on forward charge than he has following options:

- Pay tax at 5% (2.5% of CGST+2.5% of SGST), if he is not taking input tax credit on purchases.

- Pay tax at 12% (6% of CGST+6% of SGST), if he is taking the input tax credit on purchases.

2. If GTA opt not to pay GST on forward charge, then specified recipient, who is making the payment for service to GTA, has to pay tax @ 5% on reverse charge basis.

3. If GTA is providing services to recipient other than specified recipient, then such service is exempt.

Services exempt from GTA:

- Carrying-agricultural produce, milk, salt and food grain including flour, pulses and rice, organic manure, newspaper or magazines registered with the Registrar of Newspapers, relief materials meant for victims of natural or man-made disasters, defence or military equipment;

- Carrying- goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage is less than Rs. 1,500;

- Carrying- goods, where consideration charged for transportation of all such goods for a single consignee does not exceed Rs. 750 and

- Hiring out vehicle to a GTA.

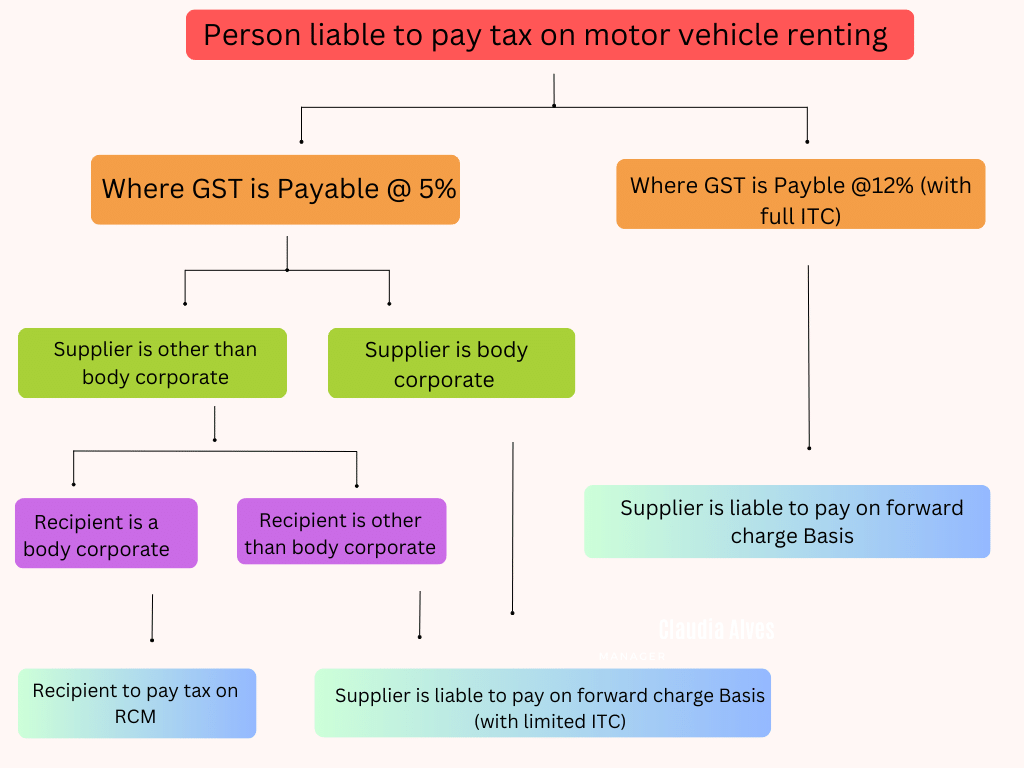

Liability in case of renting motor vehicles:

- Supplier renting the motor vehicle designed to carry passenger, where the cost of fuel is included in consideration chargedfrom recipient are taxable in following ways:

- If supplier opting to pay tax @ 12% for renting of motor vehicles. There will be no restriction on claiming ITC.

- Case where GST is payable @ 5%*, the liability will be as follows:

- In case, where supplier is “Body Corporate”, then liability will be of supplier on forward charge basis.

- In case, where supplier is other than body corporate and recipient of service is other than body corporate, liability will be discharge on Forward charge basis by supplier.

- In case, where supplier is other than body corporate and recipient of service is body corporate, liability will be discharge on Reverse charge basis by body corporate.

2. Supplier renting the motor vehicle designed to carry passenger, where the cost of fuel is not included in consideration charged:

- RCM will not be applicable. Supplier will have 2 options either pay @ 12% with full ITC or pay @ 5% with limited ITC.

Clarification regarding applicability of GST on transport of minerals from mining pit head to railway siding, beneficiation plant etc., by vehicles deployed with the driver for a specific duration of time (In Circular No. 177/09/2022-TRU, dated Aug 03, 2022):

The issue which arose for consideration was whether transport of minerals from mining pit head to railway siding, beneficiation plant etc., by vehicles deployed with the driver for a specific duration of time would be covered under entry 18 which exempt transport of goods by road except by a GTA.

The department clarified that the deployment of vehicles with driver is will classify as “rental services of transport vehicles with operator”. The person who takes vehicles on rent will direct the uses of vehicles. So said renting service cannot be said as service of transportation.

Hence, renting on such vehicles will not be exempt under entry 18.

Disclaimer:

The information provided in this content is for general informational purposes only. You should always seek the advice of expert before making any decisions based on the information provided. We do not warrant or guarantee the accuracy, completeness, or usefulness of the information provided. Any reliance you place on such information is strictly at your own risk. We shall not be liable for any damages, losses, or expenses arising out of or in connection with the use of this content.