You often heard how the phrase “The Big Apple” is associated with New York City (NYC).

Well, musicians in the 1920s and ’30s had an expression for playing the big time after gigs in one stoplight town, “There are so many apples on the tree, but when you pick New York City, you pick the Big Apple.” Which comes down to simply means the best and biggest of places to be, and New York City has long-lived up to its nickname.

The Big Apple New York is considered as one of the top business-friendly destinations in the world. Whether you are forming a Limited Liability Corporations or incorporating a legal entity, this is the destination for your global recognition.

It’s diversification, dynamism, connectivity, entrepreneurial spirit, booming tech industrialization and ecosystem of innovations makes this city not only a business hub but a global hub and home to many financial centers of the world.

Pros of Starting a business in New York.

If you’re thinking to start a business in(The Big Apple) New York City, here are the five reasons to consider to the top of your list:

1. Land of Opportunities for Networking

NYC provides abundant ground for the hybridization of ideas. The biggest city in the country brings the sheer number of companies headquarters combined with the largest consumer base in the country.

What makes this city so special is that the meritocratic nature provides ample opportunities for young talent to inter connect with well-established professionals, matching up creativity and ambition with resources and experience.

2. Buzzing with Startups

New York city has a greater student population, more cultural offerings and greater expat community than any other American city which tend to be magnet for talented young professionals. NYC ranks as the second-best technology ecosystem for startup companies and entrepreneurs with total south startup ecosystem of the city valued at around $147 billion.

3. Global Recognition

The reputation and status of running a business in City like New York is a great advantage for companies wishing to stake their hold in the global market. The successful business leaders engaged highly in knowing what business trends needs to monitor the market. Usually, NYC is ahead of many trends to “forecast” what’s happening in the world. Due to its immense diversification it tends to provide endless opportunities for your business plan.

4. Tax Benefits for Startups

Although New York is not the most business-friendly states in the USA but the city government is making it easier to start a business in NYC in form of tax Incentives, Business incentives and tax credits.

One of the most trusted and popular tax benefit programs offered by New York Department is the “Startup New York” in which specific businesses (who meets the specific criteria) can enjoy 10 years of tax-free operations in a specific location. Also, the “New Markets Tax Credit Program” gives money to businesses and real estate investors to create jobs and encourage community development.

5. Professional Talent Pool

If you want to grow your business and hire new employees, you’ll want to choose a location with a large talent pool of ambitious, talented candidates. 45% of New Yorkers are college educated and many domestic stays in the state to find work. You can find co-founders, mentors, professionals, office space mates…….and many more you can name it!! In addition, of above statement, the city bristles of other innovative companies with professionals from different cultures to collaborate together to share their ideas over meetups and this is what creates a win-win culture for your business.

Cons of started a business in New York.

The city which offers all the perks is sure to come at a price. Before ecstatic over city’s prestige and reputation we will go through all the nuts-and-bolts details that may lead you to reevaluate your decision to start a business in New York.

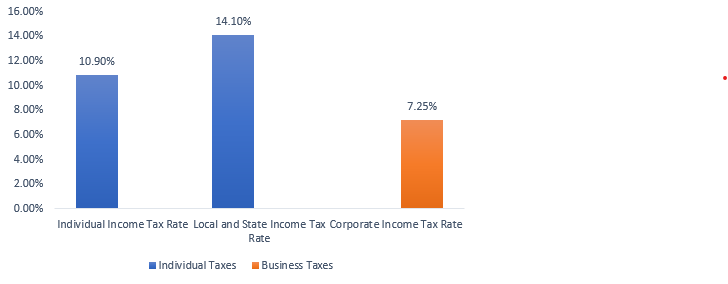

1. Expensive Tax Burdens for other than Startups and stringent Regulations

New York has fairly high-income tax rates with different tax structure. It is the moderator of lofty fines and steep taxes that intimidate the businesses and corporate profits.

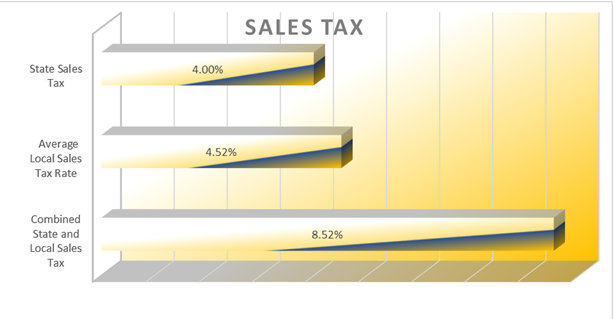

In order to maintain its progressive worldwide reputation and infrastructure, New York City has a graduated income tax, corporate tax and sales tax as per the recent study.

Here is the compilation of facts and figures for your brief synopsis:

- Individual Taxes / Business Taxes

- Sales Taxes

2. Expensive Payroll

The New York City (The Big Apple) payroll expenses is relatively higher than any other parts of USA. As living cost is elevated, the talent bases must be appropriately recouped to reflect the same. Since population of New York has attended higher level of education, you must have to pay them for their level of expertise in their respective fields.

3. High Rent with Limited Space

New York is highly dense city which ultimately makes it prime for high cost of rent as space availability is limited. The entrepreneurs find it difficult to find a space to operate their business due to high rent on leasing notoriously small spaces.

4. Competition

Being number one in global competitiveness, the sheer number of driven people in New York makes for a very competitive culture. There is no opportunity here that does not have several competitors vying for that shot. This makes it difficult for businesses to come out of the box and succeed in such a diversified economy.

Conclusion:

In a Nutshell, there are both pros and cons related to starting a new venture in Big city which offers a diverse market, a top talented community and global reputation and status but also comes with a high cost of living, intense competition and expensively high rates of fees.

But keeping in mind that challenges like salaries, rent, location, startup’s environment are common ones and you will face them depending on the structure of your business anyway so choose wisely before investing into the thought of starting a new business in New York.

Disclaimer:

The information provided in this content is for general informational purposes only. You should always seek the advice of expert before making any decisions based on the information provided. We do not warrant or guarantee the accuracy, completeness, or usefulness of the information provided. Any reliance you place on such information is strictly at your own risk. We shall not be liable for any damages, losses, or expenses arising out of or in connection with the use of this content.

Latest Blog :

DO YOU HOW TO FILE FLA RETURN?

REPORTING BURDEN ON JEWELERS RELATED TO MONEY LAUNDERING ACT